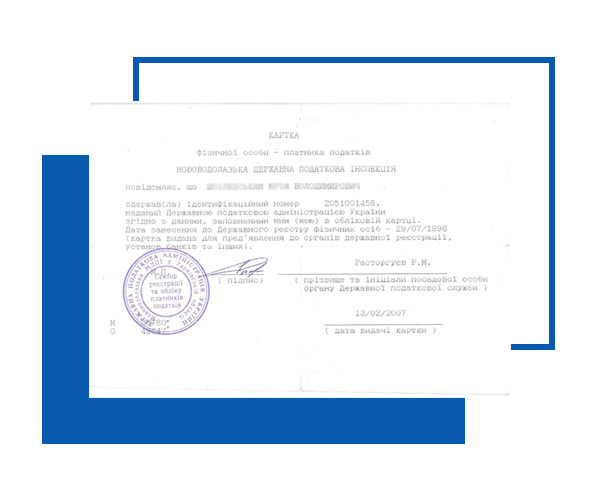

TIN | tax number

Kyiv | Odesa | Kharkiv

Take control of your financial future!

By obtaining a TIN in Ukraine, you will create a strong financial foundation for yourself and your family in Ukraine, ensuring compliance with legal requirements, transparency of financial receipts and the ability to confidently navigate the country’s tax and regulatory environment.

Dealing with the complexities of obtaining an individual tax number (INN) in Ukraine can be a daunting process. Magisters Law Office helps both Ukrainians and foreigners to go through this complex procedure. Our experienced attorneys, lawyers and tax consultants are deeply familiar with Ukrainian tax legislation, which ensures fast and trouble-free registration. Mistakes in this process can lead to unnecessary delays or penalties, but thanks to our experience, clients can rest assured that the application will be filed thoroughly and in accordance with legal requirements. In addition, our many years of successful practical experience of working with the relevant Ukrainian authorities gives us an added advantage. In addition to TIN processing, we offer comprehensive advice on tax implications and potential benefits to ensure that you are well informed and empowered to achieve financial success in Ukraine. Trust us to protect your interests and make your transition to the Ukrainian tax system as smooth as possible.

The benefits of getting a tax card:

- compliance with the requirements of the current legislation: Having an identification code ensures that individuals fulfil their legal obligations on tax payments and other mandatory contributions.

- possibility of legal employment and receiving a “white” salary: Having a taxpayer card allows foreigners to legally work in Ukraine and be officially employed by companies operating in the country.

- possible business registration: if foreign individuals intend to establish their own business in Ukraine, obtaining a taxpayer card is a necessary step in the registration process.

- access to financial services: with a taxpayer card foreigners can open bank accounts in Ukrainian financial institutions, which allows them to effectively manage their finances.

- property ownership: owning property in Ukraine requires a taxpayer card to legally purchase and register the property.

- transparent financial transactions: a taxpayer card ensures transparency of financial transactions, facilitating various official payments and financial activities in the country.

Are you a foreigner, planning to work or open a business in Ukraine? Do not hesitate! Get a taxpayer card now to open employment opportunities, open bank accounts and fulfil your legal requirements in the Ukrainian tax system.

Our specialists are ready to issue an identification code for you in the shortest possible time from 1 to three working days, and provide this service without your presence.

We’ll only need two documents for this:

- notarised translation of the foreigner’s passport into the Ukrainian language

- a power of attorney for our employee to issue a TIN

- If you have a document entitling you to permanent or temporary residence in Ukraine, a copy of the document must also be submitted

To issue a TIN to a child:

- notarised translation of the child’s birth certificate into the Ukrainian language

- a notarised translation of the passport of one of the parents into the Ukrainian language

- a power of attorney issued by one of the parents to our employee for the right to issue a TIN.

- if you have a document entitling you to permanent or temporary residence in Ukraine, you must also submit a copy of the document.

In addition, the taxpayer card is a necessary document for individuals to interact with state authorities and institutions of Ukraine. It is needed in various situations and transactions, including:

Social services: certain social services and benefits in Ukraine may require individuals to provide their taxpayer card as proof of identity and eligibility.

Health services: When accessing health services, a taxpayer card may be required for identification and insurance purposes.

Education and employment: Educational institutions and employers may request a taxpayer card as part of enrolment or employment processes, respectively.

Legal and administrative procedures: A taxpayer card is often required for legal and administrative procedures such as obtaining permits, licences or certificates.

Financial Transactions: A taxpayer card is a vital document for financial transactions, including receiving payments, processing bills, and engaging in formal financial activities.

Tax Refunds and Benefits: In some cases, individuals may be eligible for tax refunds or credits. The Taxpayer Card is necessary to facilitate the filing and processing of such claims.

Cost of Services :

Consultation on TIN registration in Ukraine ($ 30)

Full package of services for obtaining TIN in Ukraine:

- Preliminary consultation

- Preparation of a package of documents

- Submission of documents to the territorial tax authority $100

- Additional costs are possible:

- Translation of a foreigner’s passport with notarised certification of the translator’s signature $20

- Drawing up a power of attorney $20

* All prices for services, as well as the amount of the lawyer’s fee, given on the site, are approximate, are for information purposes only, can be revised depending on the circumstances of the case and are not an offer (a public offer to conclude a contract).

Important! After receiving it, keep the Tax Identification Number form in a safe place and try to keep it from damage if you need to carry it with you. The loss or theft of the TIN should be reported to the National Police of Ukraine to prevent its misuse. Remember that obtaining a tax code is an active step towards compliance, convenience and utilising the benefits available to you as a resident of Ukraine. Do not hesitate – take action and set off on the road to a smooth and rewarding financial experience.

Let’s schedule a meeting!

Schedule an online consultation with a lawyer or a meeting at the offices of the Attorneys’ Office. We will analyze your situation and find a solution that suits you!

Hurry right to the messenger !